Pre-pandemic financial realizations

Pre-pandemic, I started listening to a lot of Dave Ramsey. I downloaded EveryDollar and Quicken. I brought in exactly $1,000 a month before taxes in wages from the nonprofit. I don’t remember what my husband’s salary was at that point. Obviously, it was the only thing keeping us afloat. And by afloat, I mean barely treading water. We had two expensive car payments and all sorts of other dumb stuff financed – including a lawn mower and a four-wheeler. Besides the measly amount from my three and a half years working for the state, we had nothing invested in retirement.

I thought about our inability ever to retire Every. Single. Day. To say it haunted me was an understatement. And as the individual making FAR below my earning potential, I knew that I would have to be the one to turn things around. In fairness to me, as I mentioned in a previous post, at this point, when I was consumed with existential dread, I was making great strides to catapult my nonprofit to the next level. With the projects on the horizon, I truly believe we did hold the potential to garner the notoriety necessary to leverage the funding needed to pay me a living wage and hire full or part-time help.

Challenges amidst chaos

About the time the pandemic hit was about the time my board was reaching full chaos mode. Granted, this was my fault. I desperately needed help, and I welcomed some new board members out of my better judgment. The main troublemaker had told me they wanted to be on my board the first time I met them, and I made an immediate mental note of “not in a million years.” But, alas. I could spend 5,000 words on this tangent and still have more to say, so I’ll move on now.

The Turning Point

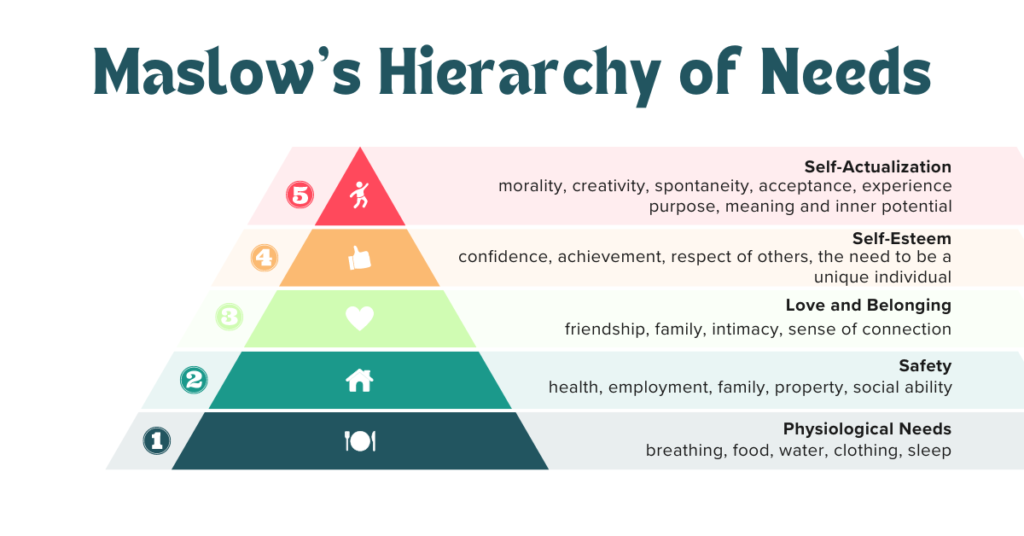

Anyway, with my nonprofit on the brink of self-implosion, a universal sense of dread surrounding the economy’s future, and uncertainty about the future of my husband’s job all coinciding, it was a really good time to re-evaluate priorities. I tried using Maslow’s hierarchy of needs to explain to my board members that the lack of a living wage significantly impacted my idea of operating at my fullest potential for the nonprofit. I kept thinking of this triangle as I grappled with coming to terms with the fact that I intended to step away from the nonprofit I’d built. And, with a strong need to figure out something to focus on that would positively impact the trajectory of our lives, I began focusing on how I would drastically change our family’s debt burden. The obvious choice involved a camper.

Becoming Camper People

For years, my husband Patrick would randomly send me links to RVs for sale. He’d make a statement about how we should live in a camper. I’d reply something like, “with all the animals.” He’d look me dead in the eyes and, without a lick of sarcasm, say, “Yeah.” So when I told him I was going to leave my nonprofit, I told him we could finally live in a camper since he could work remotely and we only lived in that location for my job. He said, “Yeah,” with a bit less enthusiasm this time since it was something that actually had the potential to come to fruition.

A week or so later, I brought it up again. At this point, Patrick tried backpedaling and claimed it would be too expensive. Unbeknownst to him, I’d spent the past month watching copious YouTube videos about full-time RVers. I read tons of blogs. I dug deep into our finances and spending. And I made spreadsheets. So when he said it would be too expensive, I had all the data to support that it would actually be the best financial decision we could make. I would not call Patrick’s response enthusiastic at this news. More like accepting.

So, I continued on with my RV community YouTube obsession – but out in the open this time. And we began spending hours driving to RV dealerships and looking at the various options. Patrick decided we needed a fifth wheel because that was the safest towing option. So then I figured out the exact model of fifth wheel we would need. Only one had a double refrigerator in the size range I wanted – so it was a pretty easy decision. And then, I painstakingly put together another spreadsheet of everything we would need to buy and the cost of each.

We drove several hours to Oklahoma to look at the first prospective camper. On the surface, it looked great, and the price was reasonable, too. But that’s where my YouTube degree and newly purchased moisture meter came into play. It had downpoured the night before, so it was easy to find ALL the leaks. We gladly drove home empty-handed. After that, Patrick decided that he wouldn’t be super helpful to the buying process, and I could travel to inspect options on my own. I did. And I continued to come up empty-handed with a winner.

In the meantime, we sold our vehicles and bought a 2011 Ford F-350. Then, we eventually found one in Houston, paid an RV inspector, and drove to go pick up our new home. It gave me an excuse to visit some cousins in Longview, TX, on the way – so that was great. We knew of a few needed repairs, so we dropped the RV off at the repair place on our way home. And on the way, we popped into our realtor’s office to tell her we were ready to sell our house!

Downsizing Journey

Though we’d been slowly selling as many of our worldly possessions as possible for a few weeks, having a listing deadline really kicked our butts into gear. Preparing to go from a 2,500 square foot home, plus two car garage, plus bonus building I used for lab space and storage, plus another detached garage…all of which were JAM PACKED full of stuff…to a 32 foot RV was…a process. But we did it.

Altogether, I think we spent about four months of downsizing before closing day. Our driveway and powerlines prevented us from moving the camper to our house. We had to wait to set things up until we had moved down to my mom’s house with the camper. We stayed there three months trying to figure out what we could bring with us and tracking down people to make the remaining repairs. Along that list of “repairs,” included installing a composting toilet. That thing was quite the experience.

Debt Milestone

But we did it! The day the money from our home sale hit our bank account, we paid off the F-350. And just like that, we owned all of our belongings. As we were downsizing and selling things, we used that cash to pay off any of the ridiculous things we had financed—like a lawn mower and four-wheeler—so we could sell those items, too.

Then, we traveled around the Gulf and South Atlantic before winding our way into Appalachia to welcome spring. By July 2021, we bought a condo and sold the camper. We eventually sold the F-350 and bought two other vehicles with cash. Besides our mortgage, we only have student loan debt left, and that should be completely paid off by next year. Our path to feeling more relaxed about our finances was pretty drastic. But I’m so grateful we did it. I don’t think we could have done it without You Need a Budget.

Looking Forward

While we’re SO much better off now than we were four years ago, we still have a long way to go to comfortably retire. That’s the next step and why I’m focusing on building a business. I’m sure there is some analogy to be made about needing to stop the hemorrhage before turning things around somehow. So much had to happen from when I first started daydreaming in early 2020 about what it would be like to feel financially secure to get us to the place we’re at now. The building phase. But it’s also taken a lot longer to get to this stage than I’d hoped. There have been a lot of distractions along the way. Arlo is one of them, but he’s the best distraction and the reason for any of the daydreaming.

Sometime in the future, I’ll write a blog post about all the distractions and how I finally got to the place I feel like I can build. But for now, I’m calling it a day.

Until next time!